Turnit digital insights for 2021

First of all, Happy New Year to all of our customers, partners and future prospects!

As usual, but especially during this unprecedented period in our industry, we have taken some time to gather our thoughts and give insight into the upcoming 2021. This time, we decided not to focus so much on the intercity bus industry trends in general as we believe the principles we outlined in our previous blog posts - 5 trends impacting intercity bus industry in 2020 , How Will COVID-19 affect Intercity Bus Industry and Consolidation – an Inevitable Future for Bus Operators back in 2018 will continue to be relevant also in 2021.

Well, At Least Now We Have Time for Digital Transformation!

Due to the COVID-19 crisis, the whole travel industry has scaled down their business to a bare minimum and some have even shut down their operations until the critical demand returns. Nevertheless, during 2020 we have witnessed a striking divergence in the mindset of operators. They tend to either be pessimistic or opportunistic about the future. And the latter already prepares for eventual rebound.

Before COVID crisis we engaged in several discussions with operators who acknowledge the importance of digital transformation. Yet, most of them admitted lacking either the knowledge or the time to actually go through this process.

Now, the situation has changed. Future-oriented operators recognize that the low demand and slow operations present a unique opportunity to break out of previous routine. It's a good time to analyse their data, streamline business processes, adjust cost structure, and implement new technological tools in preparation to provide a superior passenger service, once the demand picks up.

Eventually, another question rises up - sure, we now have the time, but how can we afford the investments in digitalization while struggling financially?

Migration To Vertical SaaS Software

First of all, research and exploration of new solutions doesn't cost anything. The least you could do is prepare for a fast execution scenario once financial stability returns.

But more importantly - there are mature, affordable pay-as-you-earn SaaS software solutions out there, which require almost zero up-front investments, while providing cutting-edge passenger experience similar to leading airlines.

We are convinced that this crisis will persuade operators to focus strictly on their core business. Instead of hiring or outsourcing bespoke software development, sharing technology with other leading operators provides drastically faster time-to-market and value for money. Bus operators should focus on their core business, developing route network, commercial decisions, and operational efficiency, instead of wasting valuable resources and time just to reinvent the wheel.

Besides, most operators tend to gravely underestimate the effort it takes to attract, educate and retain the competency and human resources necessary to run an experienced software team. Even the handling of clear requirement back-log for software outsourcing is a skill most operators find quite challenging.

Eventually, risks pile up along the months of custom software development. And in the worst case scenario the initial up-front investment might need to be written off as the outcome is unusable, either due to poor performance, lack of support or inability to adjust adequately to dynamic market requirements.

Taking all of this into account, we predict more and more operators abandoning their bespoke reservation and inventory management software ambitions and opting for off-the-shelf solutions in 2021.

More and more companies migrate to SaaS solutions

API - The New Sales Channel

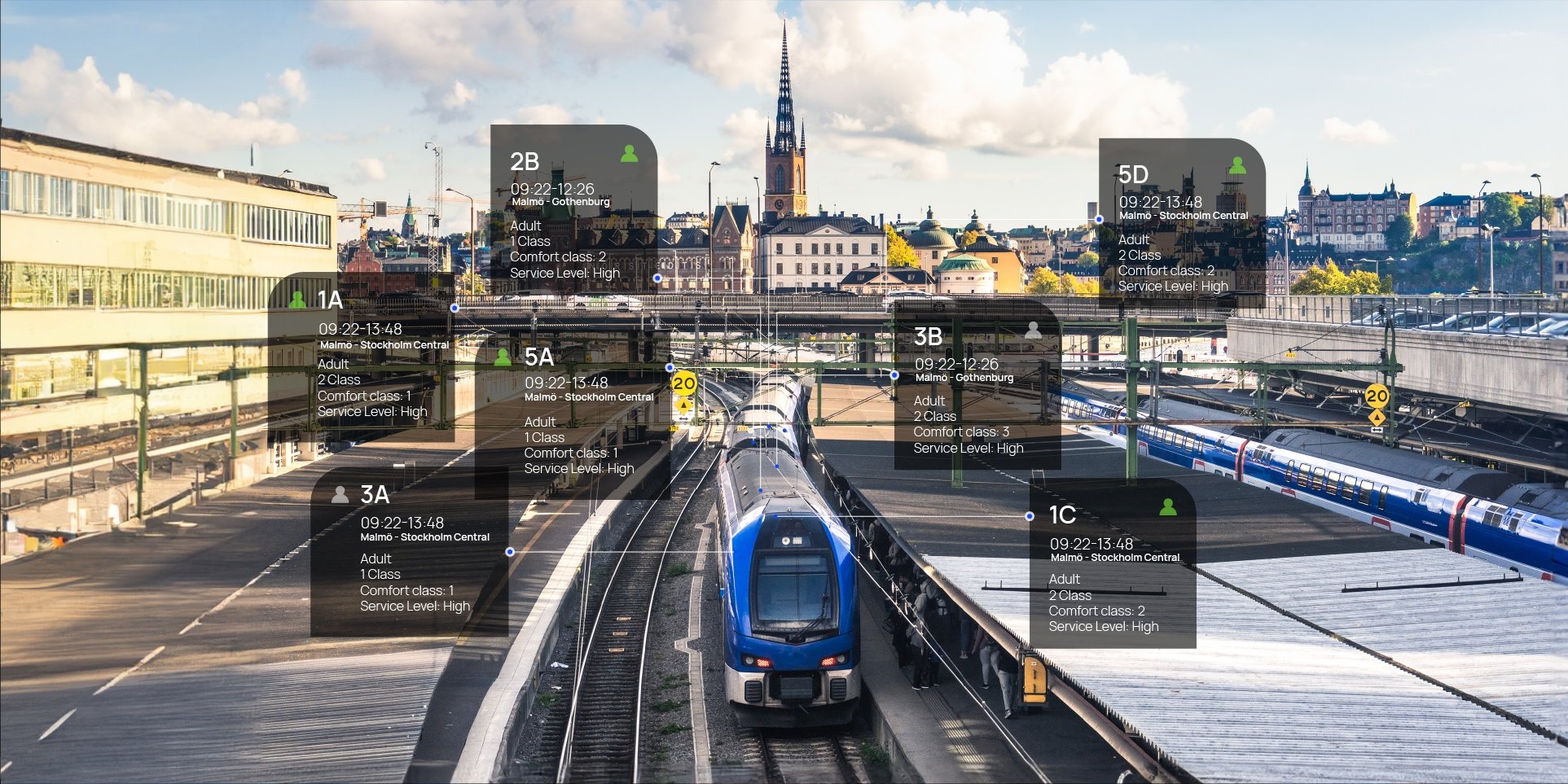

Initially there was just the bus driver selling tickets. Then, ticket offices were established in order to provide pre-sales option. At one point a well-run e-commerce website became essential. But the intercity bus industry is now starting to witness a significant rise of another important sales channel, which in other travel verticals has been dominant for years - API (Application Programming Interface) sales.

Sure, for most of the operators, API-based sales is not uncommon. It's probable that either some local or globally known OTA (Online Travel Agency) has already approached them with a distribution proposal and asked if the operator can provide them an API to start selling their product.

But this is where the commonality ends. Most digital resellers working with intercity bus industry admit that the performance of the operator's sales API-s they encounter is really poor. Many operators still rely on reservation systems designed for physical ticket office sales. While later, they have developed API-s designed for distributing only a minor part of their tickets through online resellers.

Yet, what our experience in European intercity bus industry has proven is that once the share of digital sales crosses a significant threshold and further OTA-s gain access to content over this API, the amount of requests compared to sold tickets (conversion rate) increases exponentially. Systems not designed for such volume will crumble, resulting in the worst case scenario: the potential loss of tens of thousands of euros due to the inability to meet the increased demand for ticket sale.

Considering the COVID-driven surge in e-commerce, we strongly encourage operators to pay attention to the health and performance of their reseller API-s and address the underlying issues in their reservation system architecture. We have written a specific blog post about the importance of API-based sales and its impact on technology infrastructure. Check it out here!

Rethinking Revenue Management (RM)

Traditional RM technology has been based upon algorithms that focus primarily on historical demand patterns – such as booking lead times, booking pickup by segments and seasonal travel patterns by day, week or month – as a basis for determining the best possible fare, at any given time.

Such approach works well, when you have somewhat normal, predictable market conditions for travel demand. Unfortunately, the COVID-19 crisis has redefined the norm, big time. So, how can you rely on Revenue Management automation without reliable information on upcoming demand data, in a situation where historical data is no longer applicable?

The ugly truth is - you can't. Especially in such a volatile situation where restrictions on capacity and destinations are so unpredictable that decisions might need to be made in real time.

As a result, we are witnessing operators scaling back their dynamic pricing schemes and sometimes reverting to fixed pricing entirely in order to reduce workload and retain predictability on their revenue streams.

Such approach might fit with the current low demand situation but what happens when demand starts to pick up again, for example summer 2021 and onwards? It's not like travel will suddenly return to the same level as pre-COVID, so historic data still won't provide any relevant insight. Yet, in order to incentivize the demand and tackle harsh upcoming competition, accurate and dynamic pricing will become crucial.

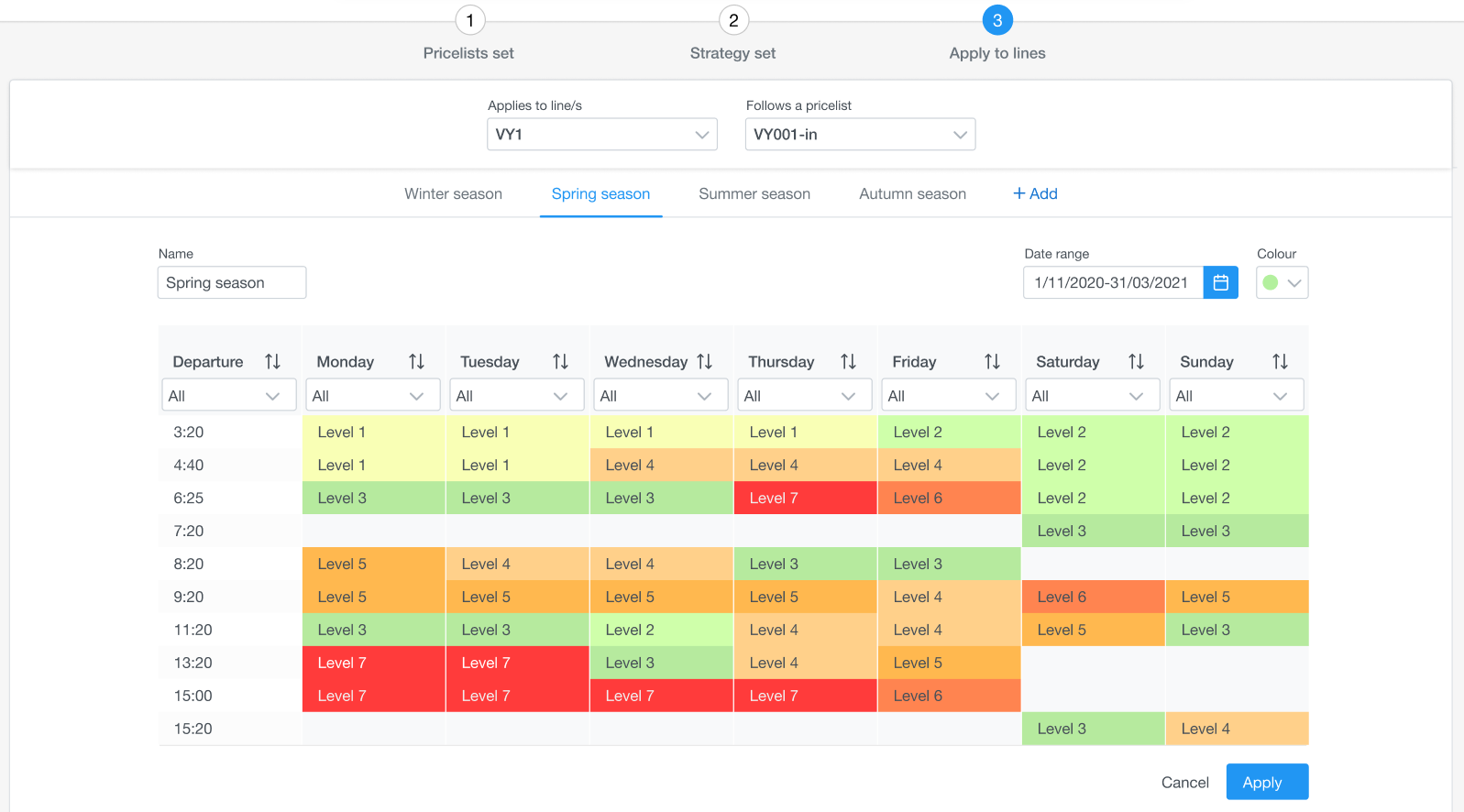

Turnit focuses on flexible pricing strategy management tools

Instead of automated algorithms, revenue managers will now need to start adjusting their pricing decisions manually in real time, according to changes in the competitive and demanding landscape. In order to tackle such workload, Turnit is continuously focusing on streamlining the dynamic pricing definition and overriding tools, with the goal of eventually being able to build up situation-dependent dynamic pricing strategies and switch between them with minimum effort.

For the foreseeable future, savvy revenue managers (the human element) are an integral part of an operator's financial success. And you don't want to burden them with administrative tasks when it's imperative to focus on the macro-level strategic decision-making and data analysis instead.

Conclusion

The new reality that the COVID crisis has brought to the industry, will certainly impact it also during 2021. But we, at Turnit, are also confident that at least for those operators who are set both financially and mentally, digital, contactless and frictionless passenger experience will be a matter of hygiene (yes, literally as well) for faster recovery.

With that in mind, such operators must already today build up the internal competency to drive digital transformation, taking into account scalability, cost-effective operations, automation, omni-channel sales distribution and hyper-agile commercial offer. It's a multi-layered task, involving many moving parts and a lot of experience. We at Turnit are more than welcome to consult, help and also implement those tools in order to speed up the recovery as soon as the market wakes up again.