How will COVID-19 affect Intercity Bus Industry?

After 20 years of working in the intercity bus industry, we never even imagined to witness a situation where almost all intercity bus traffic is stopped within 2-3 weeks. Unsurprisingly, it took some time for the industry and also for the team of Turnit to adjust to this unprecedented situation.

Nevertheless, now more than ever it’s important to talk to our clients about their expectations and ways we could be of help in reviving and jump starting their business once the travel restrictions have been reduced.

In general, we strongly believe that the regular intercity bus industry will be one of those modes of transport to revive relatively faster than the airline and long-distance holiday travel. Mainly due to intercity bus lines being regional and often of domestic nature, thus being re-opened earlier than international travel. They are also essential for some passengers for commuting purposes and probably the simplest way to escape the long captivity back home. We are also convinced that rebound will be much faster on the markets like LATAM and Africa, where long-distance travel is dominated by bus & coach.

But it’s quite apparent that total recovery and regaining of passengers' trust in shared vehicles will only be restored with a vaccine or other medical resolution. Thus, many operators will be struggling with lower ridership and need to optimize their whole business to stay afloat.

In this blog post our goal is to propose main trends we foresee for the industry in the post-COVID-19 world.

1. Market (re-)transformation

We at Turnit don’t pretend to have a crystal ball and in such unprecedented times, it’s quite difficult to predict any definite trends. Yet, if we assume the current situation doesn’t resolve fully in next 3-4 months, the impact on the whole industry will be very serious. Of course, depending on the market, the following trends might be different but nevertheless it makes sense to highlight them.

Many intercity operators will have at least temporarily more buses in their hands than they can utilize. As it will be quite difficult to rapidly reduce fleet size, they must look for other ways to cut their costs. We predict smaller regional operators will start consolidating under unified brands in order to optimize their expenses on route & resource planning, sales & marketing, driver pools, innovation and management costs.

Yet, we don’t believe there will be one brand to rule them all, at least on deregulated commercial markets. We rather believe in regional, very efficient and resourceful teams managing pools of up to a couple of hundred coaches, utilizing readily available software, digital and physical sales network and smart local marketing schemes, in order to quickly fulfill the sweet 200-400km radius market around bigger metropolitan areas.

Although the debate is still out there, we are quite sceptical about the sustainability of the so-called Uber model where a global “assetless” brand runs a vast network of subcontracted buses earning 25% revenue share. It makes a lot more sense to develop a great brand, customer experience, management team and invest in cutting-edge technology with significantly less than that. For example, running a full set of Turnit Ride SaaS platform would cost only 1-2% of your revenue!

With venture capital taking a more cautious approach to travel and mobility related start-ups, profitability over expansion will become inevitable. Such market reset opens a unique window of opportunity for local smart entrepreneurs to establish their own well-run local bus companies, using mature and market-proven business management software, while avoiding heavy up-front investments. Eventually it will be quite expensive for anyone to topple such dynamical and entrenched local market leaders.

2. Rise of multi-modality

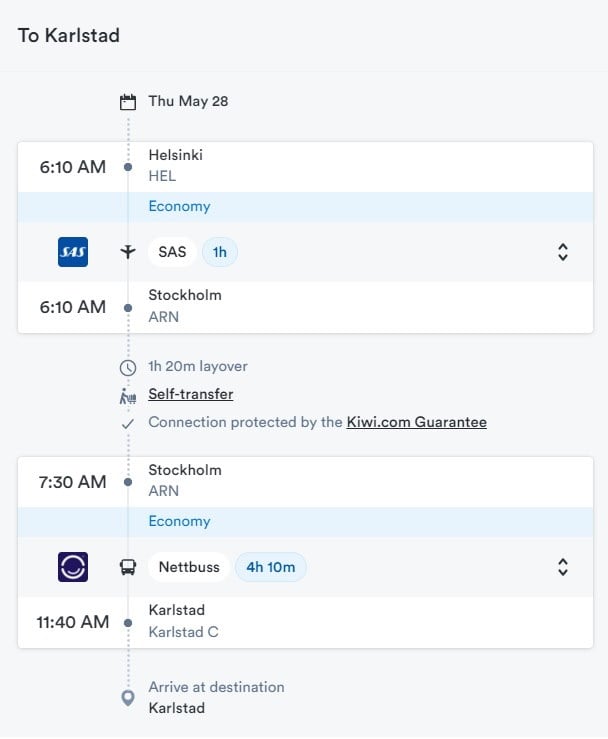

With global airlines being under immense financial pressure for months and maybe even years to come, many of them are forced to reduce their previous route network. This could turn into a great opportunity for well-run and reputable intercity bus operators to develop deeper co-operation and interlining agreements with the airlines in order to fill resulting gaps and expand feeder networks, especially on unsustainable short distance feeder routes.

Crippled airline supply will hopefully incentivize travel OTA and GDS services to double their efforts towards truly multi-modal journey planning and booking experience with bus, rail and airlines being interlined seamlessly into one customer experience. Considering the complexity of virtual interlining, such a task is not probably fit for small local OTA-s and will rather help well-capitalized global players like Kiwi.com and to solidify their position even further.

It goes without saying that for intercity bus industry to keep up with such rapid change, necessity to digitize their operations and develop omni-channel API integrations might eventually become a matter of survival.

3. Closer co-operation with authorities

We predict that intercity bus operators who so far were somewhat less dependent on local authorities, should expect this to change.

For example, it’s quite reasonable to expect that authorities will want to gain easier access to travel data in order to quickly track down fellow passengers if they should be unfortunate to travel with someone infected with COVID-19.

But even more, we expect many rural regions to increase subsidies or downright recapitalize intercity routes in order to maintain critical transport corridors, which become unsustainable to operate under fully commercial terms. From our experience, local transit authorities, due to their commuter-specific focus, rarely possess tools required for intercity bus operations. Features like seat reservation and capacity management are not usually required in urban and suburban mobility. Thus it will become important for those authorities to develop these capabilities overnight and usually, off-the-shelf SaaS solutions are the easiest solution.

4. Seat selection will become essential feature

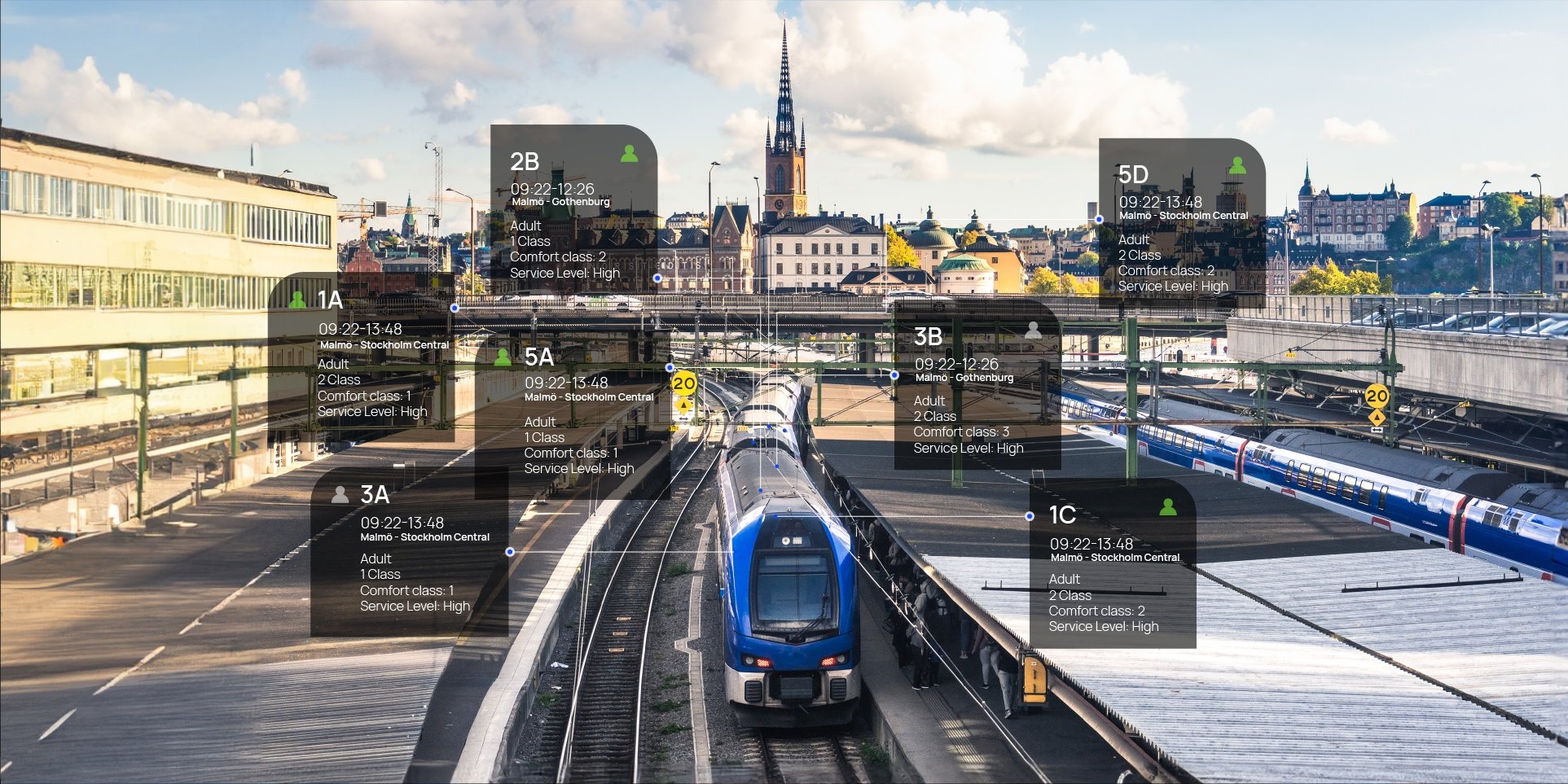

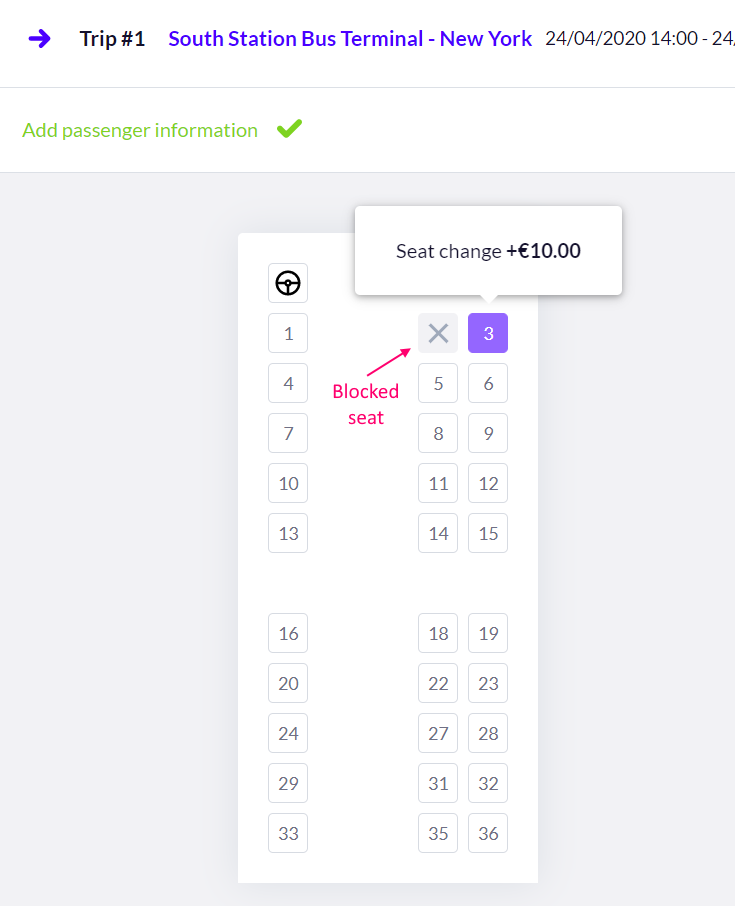

As social distancing will be the new norm and way to build confidence among passengers, operators will need to evolve in their capacity handling. One thing we are absolutely certain about - the ability for passengers to select their specific seats and operators to commit on those choices will be the new standard for any serious bus operator. To achieve this, operators must follow these steps:

- Profile and visualize seat layouts for all of their vehicles, including the ones they will be hiring in.

- Figure out the most efficient layout which would adhere to social distancing measures while maximizing ridership. By blocking certain seats, it’s possible to create distance between passengers and also clearly communicate visually this layout to the passengers. We believe upscale operators will have a bit bigger advantage as they have more legroom and space between individual passengers and are better positioned to up-sell this advantage.

- Assign specific vehicle seat layouts to specific departures and keep up with operational vehicle changes. A modern reservation system should be able to automatically re-assign existing passengers to new seats and notify them about such change, thus streamlining associated manual work. It goes without saying that with an omni-channel distribution system, all new incoming bookings should adhere to the vehicle adjustments in real time as well.

5. Streamlining of operations and customer communication

As long as there’s no vaccine, there might be pockets of virus rebounding in certain regions, operators must be ready to quickly react to close those stops, redivert and even close routes at a moment's notice. Such operational adjustments need to be communicated quickly throughout the reselling network and of course to affected passengers, thus running an efficient omni-channel distribution and automatic pre-configured notification system with e-mail, SMS and in-app push notifications is of essence.

Considering the increased need for frictionless yet flexible operations, carriers especially in high-salary regions will need to opt for technology that streamlines and automates their workflows. We believe carriers with such capabilities will gain a strong competitive advantage and strengthen their position for mounting market consolidation.

Conclusion

Whichever way we look at it, COVID-19 crisis will have a huge impact for the whole intercity bus industry. There will be winners and losers but one thing is for sure - this crisis will only intensify the digitization process of the industry as it will take even more effort to regain the lost customers, increase loyalty and recurring purchases and even more important - streamline, optimize processes and cut costs.

Turnit’s experienced and industry-focused team with its mature and robust reservation and inventory management platform is always ready to assist operators around the world in their rebound efforts. Our portfolio of large and well-established customers is a great source of first-hand advice on how to steer Turnit Ride product further towards the calmer waters. Feel free to join us on this journey!