Third-Party Resellers in Intercity Bus Industry: Part 2 – GDS

In the first volume of this series of posts dedicated to 3rd-party resellers, we talked about the OTAs (online travel agencies). In today's post, we will examine GDSs, but don't forget to read the third part about metasearch engines as well.

But why are we dedicating three whole articles to indirect channels for your sales?

Third-party resellers enjoy a huge online presence.

With increasingly more travelers using the internet to search for the most convenient ways to travel, compare the prices and finally book their trips, OTAs, GDSs and metasearch engines are deemed to remain important players.

Deciding to appear on these websites or not is a crucial decision for your business. With this guide, we give you all the tools you need to make the best possible decision.

1) What is a GDS?

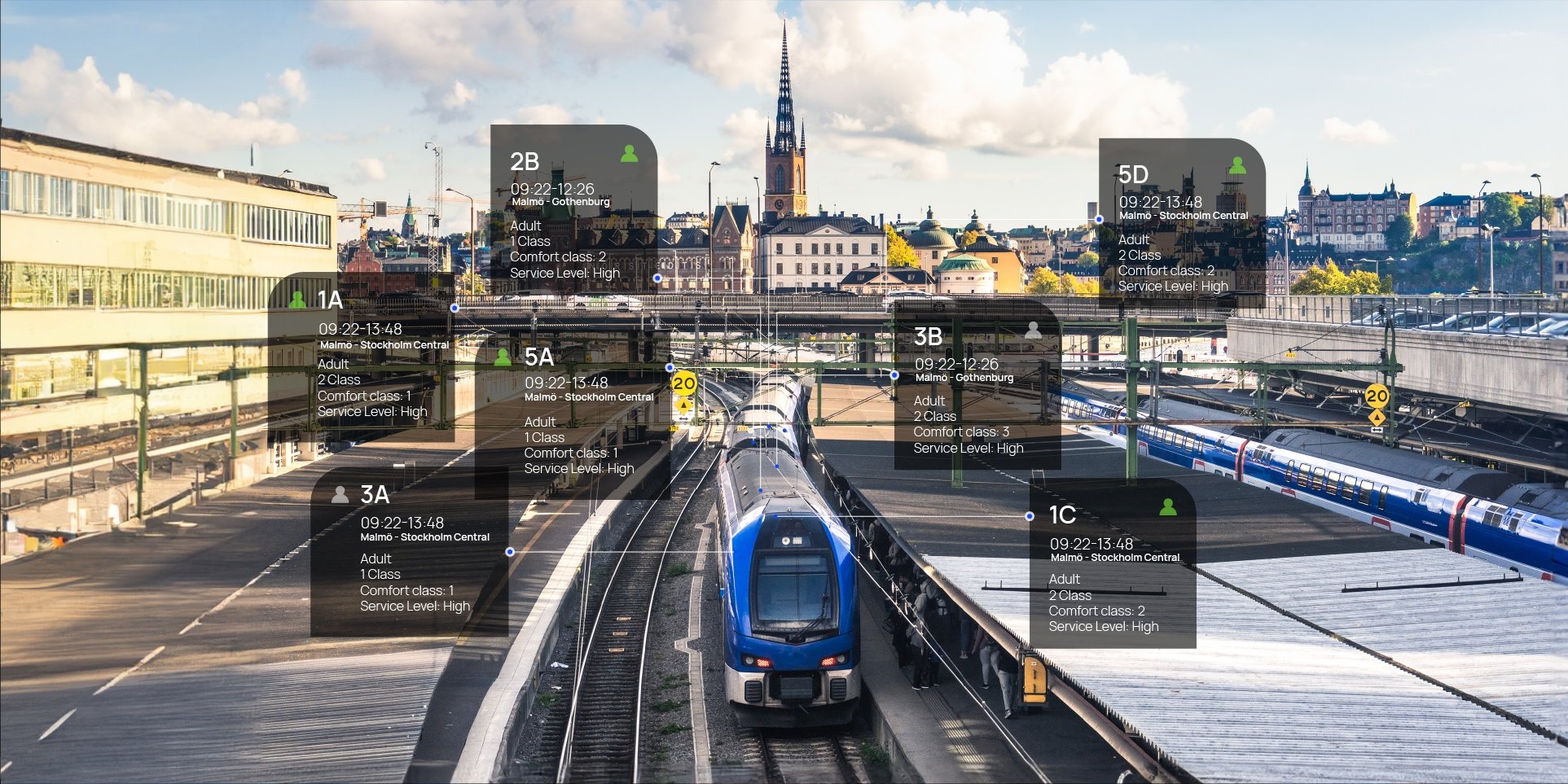

GDS (Global Distribution System) is an online reservation network that enables travel agencies, online reservation sites, and large corporations to compare and reserve airline seats, hotel rooms, rental cars, and other travel-related items.

Unlike OTAs, GDSs are B2B tools only. They gather commercial offers from travel industry operators and make them available for other businesses.

A GDS offers access to an extensive inventory of various travel products in real time, 24 hours a day. The most prominent global travel distribution systems are Travelport, Amadeus, and Sabre.

For the intercity bus industry, the emerging GDS providers are still in early development phase. One of the most relevant GDS service providers in Europe is Distribusion. There are also companies specializing in providing intercity bus content through both B2C and B2B business models, one of the most known being BusBud.

2) How does a GDS work?

The GDS collects the data (inventory and fares) from the travel industry operators and passes it on to the reselling agencies and OTAs.

Operators can choose to either use a pooled method of inventory or allocate specific inventory to the GDS. Operators that partner with a GDS send their fares, availability, and offers to the network, enabling the agents associated with the GDS to place reservations for the final users.

As the GDS acts as a technical intermediary between service providers and actual resellers, its technical competence usually differs from an OTA’s.

OTAs need to integrate different operator’s APIs while developing front-end channels in order to sell the gathered content to travelers. GDSs, on the other hand, can concentrate only on engineers integrating both the operators’ and the agencies’ APIs. They don’t really need a separate front-end development team.

3) What is their business model?

The logic for using GDSs is that they ease the access to the product for all parties involved. For agencies, it means access to a great number of deals in real time. For operators, selling through a GDS equals having multiple resellers, minus the hassle of managing them all. This is especially true regarding the physical sales points, where operators can extend their geographical reach much further thanks to GDSs.

The business models of GDSs resemble in part those of OTAs. Global distribution systems either charge a commission for every item sold through their network or have a revenue share agreement with the operator.

4) What should you know?

Long-distance bus operators relate to global distribution systems in different ways than airlines do.

Traditionally, the GDS provided the „central nervous system“ for the airlines’ sales. In fact, GDSs were created in the 1950s precisely by the airlines. The goal was to create a system to distribute their seats through travel agencies. Later, these systems expanded to hotels and car rentals.

The more travel industry is paying attention to long-distance bus operations as part of the multimodal travel chain, the more modern and forward-thinking operators start paying attention to participating in GDS networks.

Today, as more established airlines are benefiting from technological advancements, they have started looking for ways to sell directly by using their own APIs and depend less on the GDS networks. One of the reasons is that many big OTAs are becoming technically capable of integrating airlines systems without an intermediary and the relative costs.

For the long-distance coach industry, sales through GDS are still at an early stage. There are two reasons for this:

- Intercity bus industry is still considered as more local (as opposed to global) by nature.

Because of this, many operators don’t believe that selling through GDS network can bring them more value compared to the sales network they already operate today in their local region.

- Depending on the size of the operator, selling only through a GDS might be too costly as they might end up paying a double commission (to the GDS and the selling agency).

Yet, the more travel industry is paying attention to long-distance bus operations as part of the multimodal travel chain, the more modern and forward-thinking operators start paying attention to participating in GDS networks.

The main benefit for an operator to plug into a GDS distribution network is, of course, the reduction of hassle related to managing all reselling partners. This is especially beneficial if there are hundreds of reselling agencies to cover and handle.

But in the end, as mentioned already before, mindful operators should always balance and track their distribution strategy to cut their sales costs with the biggest value created.

Follow us to read the last part of the series, dedicated to metasearch engines. Lately, there has been much talk about this channel: find out what is in for the intercity bus industry by subscribing to our newsletter and you'll be the first to know.