What Are Revenue Management, Yield Management, and Dynamic Pricing?

The concepts of revenue management, yield management, and dynamic pricing are becoming more and more recognized in the long-distance bus industry, but these three terms are often confused. In our conversations with clients, we see the terms regularly misused, which can lead to misunderstandings or, in the worst case, bad decisions.

The aim of this post is to clarify these concepts and explain their relation to each other as well as their differences.

Differences and Similarities Between Yield Management and Revenue Management

Both concepts aim to reach the goal of maximizing yield. When they first appeared in the 1980s, it was applied to the airline industry. Since then, its application has reached other passenger transport industries as well as hotels and, more recently, e-commerce.

Yield management and revenue management apply analytics to predict demand and other consumer behavior and optimize attendance and price. In other words, they are employed to “sell the right product; to the right customer; at the right time; at the right price”, according to the definition of Robert Cross, the theorist behind airline revenue management.

Both concepts are based on the principles that:

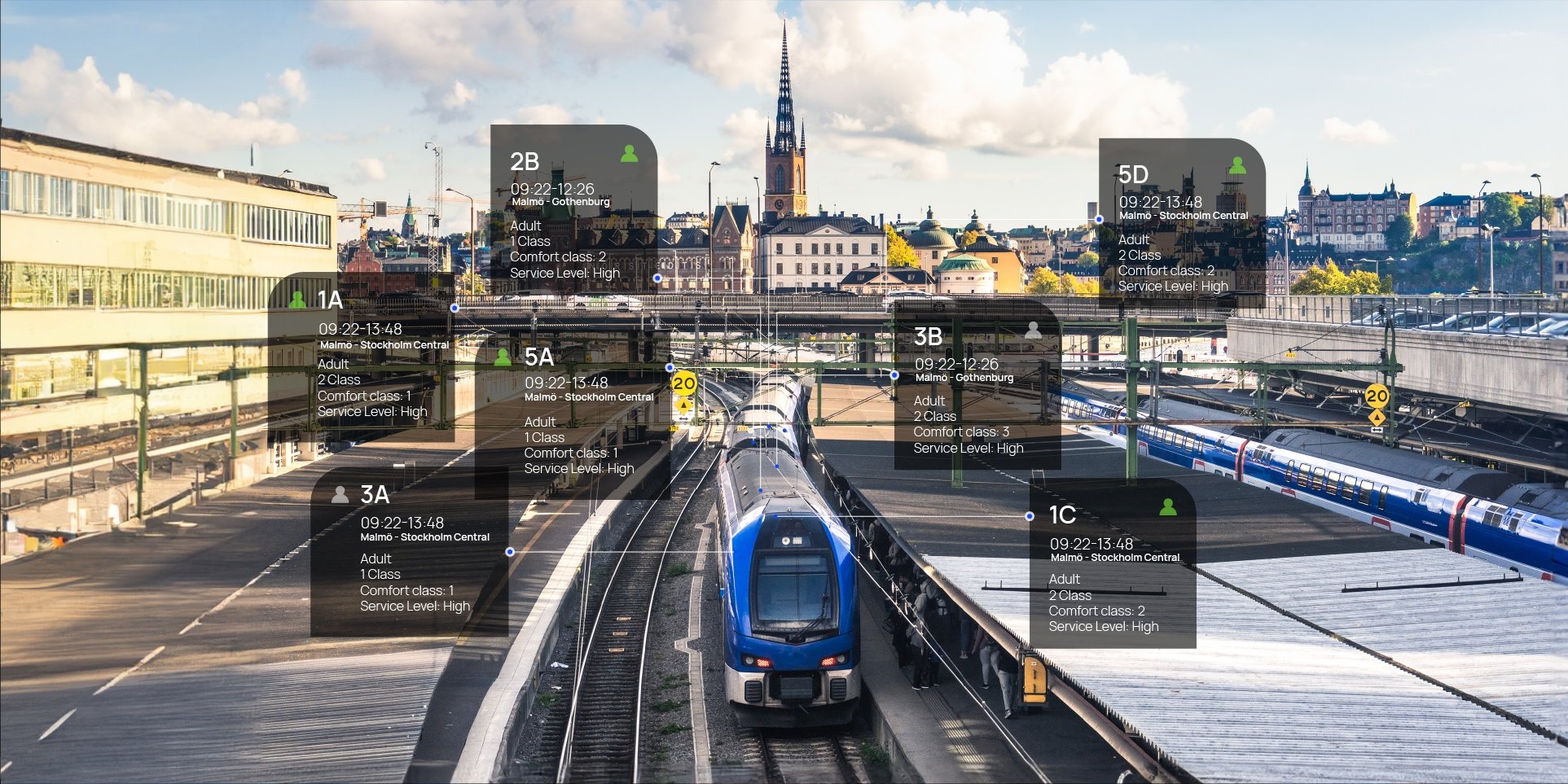

• The inventory is perishable: a product is only available for a certain amount of time. In the case of a bus trip, a seat reservation has a value until the bus departs.

• Different customers are willing to pay different amounts for this perishable product: in our case, it means that they pay different amounts for the same trip.

When a company offers the highest price at the right time, that is when demand is high, to make the most profit, they are applying yield management. It focuses on the assumption that the amount of the product is limited: on a bus, there is only a certain number of seats.

Hence, the only way to maximize revenue is to adjust the price.

The goal of yield management is to define the best possible compromise. In the bus industry, it tries to answer the question: how many bus seats should an operator allocate for each price segment in a certain time span?

However close, yield management and revenue management are not interchangeable terms. While these two concepts are similar, yield management was theorized earlier on and its focus is narrower. Yield management does not take into account the cost associated with the service (such as fuel and labor) and ancillary revenue (for example, bottled water or an extra luggage on a bus). It focuses only on the selling price and the volume of sales to generate the largest possible revenue from a limited and perishable inventory.

Yield management is thus falling under the umbrella definition of revenue management. Revenue management is a broader term that indicates a pricing strategy applied by a company when considering revenue altogether, including cost and ancillary revenue.

To ensure the success of pricing strategy, an operator must understand how a customer thinks and what value a product holds for them.

A revenue management strategy is especially relevant in the passenger transportation industry, where the cost related to scheduled departure (i.e. fuel, driver salary, vehicle amortization etc.) has a significant share in the business’ budget. This share of cost has to be met regardless of revenue generated from ticket sales. By applying a correct pricing strategy, an operator can increase average revenue per departure without increasing their own costs.

To ensure the success of pricing strategy, an operator must understand how a customer thinks and what value a product holds for them. This means that an operator can price business class seats at a premium due to business travelers typically being less price conscious. At the same time, an operator can offer discounts on non-business class seats in order to fill up a bus.

Dynamic Pricing

Dynamic pricing is not a pricing strategy. Instead, dynamic pricing is a way of pricing a product according to different rules. It is applied based on the broader formula of revenue management. While revenue management can include a dynamic pricing of seat inventory, a successful revenue management strategy can also be based on fixed pricing.

Since dynamic pricing refers to how much pricing can be adjusted over time in response to changing demand, dynamic pricing suits the needs of long-distance passenger industry, where limited inventory drives the need for revenue and occupancy maximization. Using dynamic pricing, it is possible to recalculate and optimize price in real-time, as often as necessary, to maximize revenue and increase margin.

Dynamic pricing is driven not only by supply and demand. Because of process automation, a wider spectrum of data can be processed and used for price optimization. Algorithms that calculate and adjust prices take into account other factors. For example, competitor prices, cancellation rates, and others.

Conclusion

Understanding the concepts of revenue management, yield management, and dynamic pricing as well as their differences is essential for any manager in a bus company operating scheduled long-distance services. Adopting an effective revenue management strategy helps to make the best pricing decisions and maximize revenue in this low margin industry.

The application of a revenue management discipline to the long-distance bus industry adds another challenge. The number of different stops in one trip creates different segments which can be overlapping for different passengers. Thus, a challenge for commercial managers in the bus industry is also to sell a seat for the longest possible segment of the trip.